I was born on - Month of Birth. From 15 A Month.

Term Vs Whole Life Insurance What S The Difference Policyme

Download the offline calculator.

. With most whole life plans your premiums monthly or annual fees remain the same regardless of changes to your health. Current life insurance coverage. What is participating life insurance.

Tell us a bit about yourself and well calculate the amount of life insurance you need to protect your family. Ad Senior Life Insurance With No Exam Fast Coverage. Rates starting at 11month.

A truly an independent agency working for you. Whole life policy calculator whole life insurance calculator premium whole life insurance rates chart whole life insurance value calculator whole life cash value calculator. No medical exam or physical required - just a few simple health questions.

13 monthly or 148 a year. There are different types of life insurance and. Further whole life insurance rate quotes can be specified as to exam and no exam required carriers.

Ad Up to 20000 life insurance cash and every policy includes funeral arrangement assistance. Remember that under a 10 year term life insurance policy these rates are guaranteed not to change for 10 years. Delivering Top Results from Across the Web.

Why Choose LSM Insurance For Whole Life Insurance. Get a recommendation in minutes. Ad This is the Newest Place to Search.

Whole life insurance is a type of permanent life insurance as opposed to term life insurance. Rates starting at 11month. Please check out our article on accelerated underwriting if you prefer whole life.

Many clients will combine a whole life plan with some term optimizing the cost of coverage when you have both a short term 10-30 year need and a lifetime need. Its lifelong coverage that pays whomever you choose a tax-free payment when you die. Your debts and final.

Ad Exclusively for AARP Members. At PolicyMe we believe most Canadian families need term life insurance not permanent policies like whole and universal. For example if your term life estimate is 35month heres how to calculate your cost range for.

Life insurance provides whomever you choose with a one-time tax-free payment when you die as long as you continue to pay your premiums. This calculator only recommends term life insurance options. Life Insurance Coverage In 3 Easy Steps.

The Purpose of Whole Life. Look For Awesome Results Now. Ad Term and Whole Life Insurance You Can Rely On.

Estate Protector and Wealth Accelerator to address. This quote is based upon the. Estimate The Value Of Your Life Insurance The Cash You Could Receive With Our Calculator.

Whole life insurance vs. That is a very general estimate but in over three decades. Cost of life insurance calculator whole life insurance rates whole life premium chart whole life insurance value calculator whole life insurance rates chart whole life cost calculator single.

Ad Use Our Calculator To Get a Free Estimate of The Value of Your Life Insurance Policy. Guaranteed premiums that are payable for 10 years 20 years or to age 100. Your policy is guaranteed to grow in cash value as long as you pay.

From there you can calculate your expected cost for whole life insurance. Ad Get a Modified Whole Life insurance policy from Physicians Life Insurance Company today. Tell us a little about yourself and well suggest a coverage amount.

Make Sure You and Your Family Are Protected With This Life Insurance Calculator Life Insurance Calculator Canadian Definitions. Premiums benefits and investments. Whole life insurance provides guaranteed life insurance protection that does not expire.

There are three main differences between whole and universal life insurance policies. I was born on. MM Jan Feb Mar Apr May Jun Jul Aug.

Get inexpensive coverage in place today and be ready for the unexpected. A good rule of thumb is that a whole life policy for a 40-year old male a 500000 death benefit will cost you about 500 per month. Whole life insurance provides coverage for your entire life.

Ad Exclusively for AARP Members. Trusteed For Over 100 Years. Use our life insurance calculator to help determine the amount of life insurance coverage necessary to protect your family in the event of your death.

Licensed across Canada and working with. 14 - 16 per month. There are two basic types of whole life insurance guaranteed and non.

With BMO Insurance Whole Life youll get. With whole life insurance you will pay a level monthly premium that is guaranteed for the duration.

How Much Does Whole Life Insurance Cost Policyadvisor

Get Whole Life Insurance Online Policyadvisor

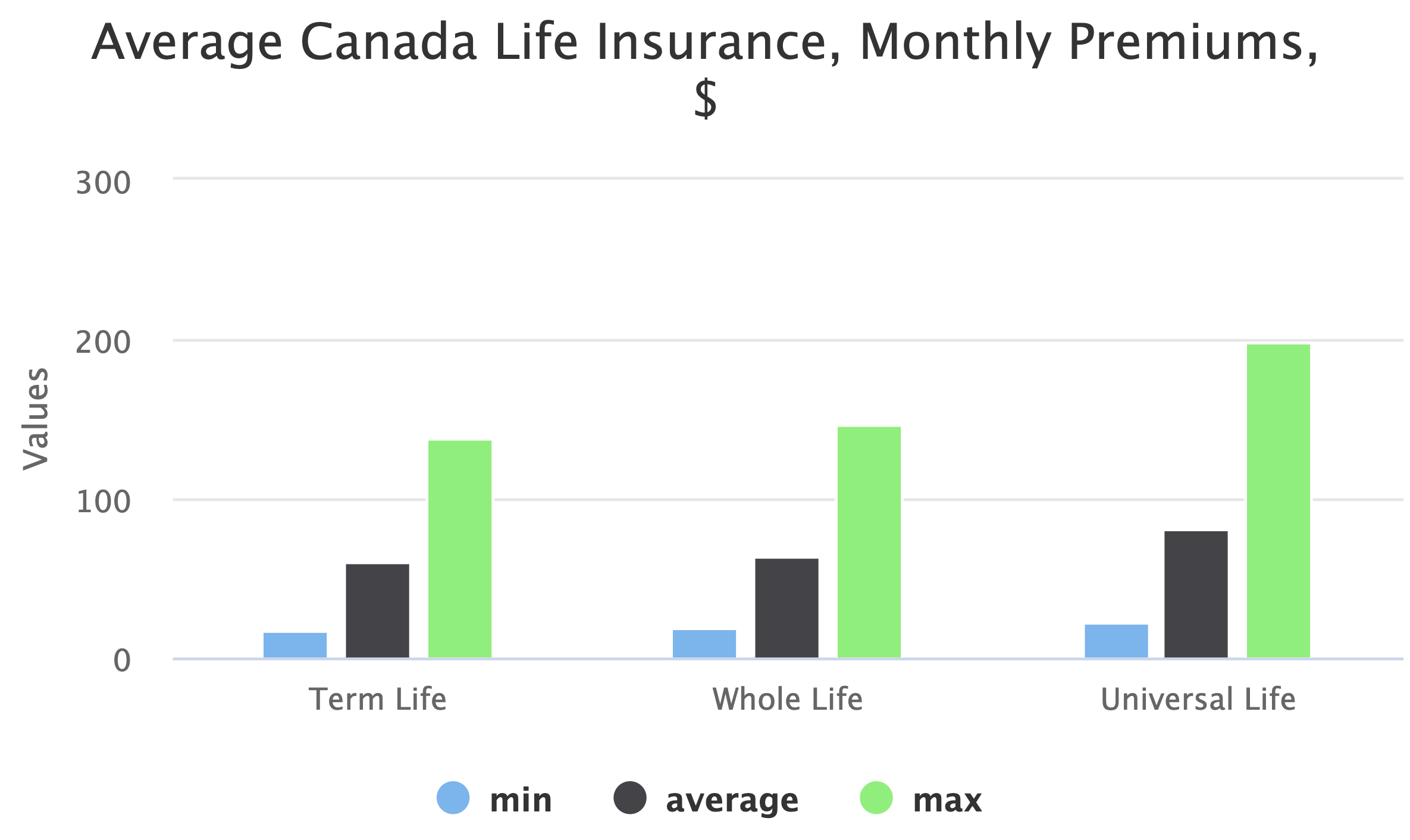

How Much Is Life Insurance In Canada Average Costs Policyme

Term Vs Whole Life Insurance What S The Difference Policyme

How Much Is Life Insurance In Canada Average Costs Policyme

Cash Value And Cash Surrender Value Explained Life Insurance

Best Life Insurance Calculator Canada Policyadvisor

Best Life Insurance Canada 2022 Company Reviews Policyadvisor

Term Life Vs Whole Life Insurance Daveramsey Com Life Insurance Quotes Whole Life Insurance Life Insurance Marketing

Cash Value And Cash Surrender Value Explained Life Insurance

Cash Flow Banking With Whole Life Insurance Explained

Cash Value And Cash Surrender Value Explained Life Insurance

Average Cost Of Life Insurance In Canada 2022 Dundas Life

How Much Is Life Insurance In Canada Average Costs Policyme

How Much Does Whole Life Insurance Cost Policyadvisor

Best Life Insurance Quotes In Winnipeg 20 Life Insurers Compared

How Much Is Life Insurance In Canada Average Costs Policyme

How Much Does Life Insurance Cost In Canada In 2022 Policyadvisor

How Much Does Whole Life Insurance Cost In Canada Life Insurance Cost Whole Life Insurance Life Insurance Calculator